EXECUTIVE SUMMARY

The Sacco Societies Regulatory Authority (SASRA) has released its annual supervisory report for the SACCO sector in 2017. SASRA has the authority to supervise deposit-taking SACCOs. We shall focus mainly on technology specific elements in this report after giving a highlight of the performance. In the year 2017, the total number licensed SACCOs were 176, but two SACCOs had their license revoked due to failure to meet financial obligations, living behind 174 SACCOs operating in Kenya.

The net worth of the SACCOs grew by 12.4% t to reach Ksh 442.27Billion from Ksh 393.29 Billion in the year 2016. Net loans and advances remained the key component of the assets portfolio of -SACCOs accounting for 72.46% of the total assets portfolio.

It also noted that the gross loan portfolio increased by 11.3% in 2017 to reach Kshs 331.21 Billion from Kshs 297.6 Billion recorded in 2016 while deposits registered an aggregate growth of 12.01% to reach Kshs 305.3 Billion in 2017 from Kshs 272.58 Billion recorded in 2016

CONNECTIVITY

SACCOs have expanded with 464 physical branches spread out in different parts of the country. The SACCOs were able to connect and interact with its branches and Customers through;

- Automated Teller Machine (ATM)

- Mobile Application through the Service Providers.

- Cheque Partnerships

- Agency Banking

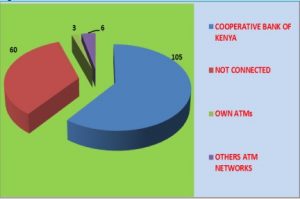

AUTOMATED TELLER MACHINE (ATM) LINKAGE

A total of 114 -SACCOs were connected to and/or were using one ATM, however, 60 SACCOs remains unconnected to an ATM platform, while six (6) other SACCOs are connected to different ATM platforms. Cooperative Bank of Kenya, however, remains the largest provider for ATM connectivity services to SACCOs.

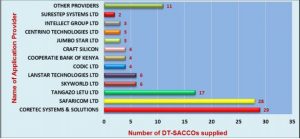

MOBILE APPLICATION SERVICE PROVIDER

Over 120 SACCOs are already connected using one mobile application or the other with the majority being connected to application systems provided by Coretec Systems & Solutions Ltd, Safaricom Ltd and Tangazo Letu Ltd.

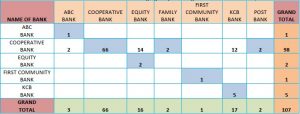

CHEQUE PARTNERSHIPS WITH BANK

The analysis shows that Cooperative Bank of Kenya has partnered with the highest number of SACCOs which stands at 61 SACCOs thereby cementing the critical role the Cooperative Bank of Kenya continues to play within the SACCO sector.

AGENCY BANKING ACTIVITIES

Just as with ATM connectivity as well as the Cheque partnerships for the issuance of cheques, Cooperative Bank of Kenya has the most number of SACCO Societies acting as its agent at 66 SACCOs; followed by KCB Bank with 17 SACCOs, while Equity Bank had 16 SACCO acting as their agents.

COMPLAINTS, INQUIRIES AND DISPUTE

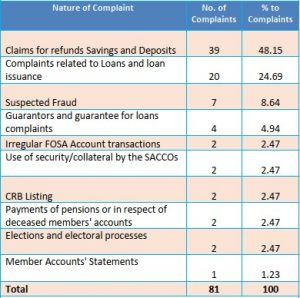

With a total of 81 complaints reported in 2017, Suspected Fraud, was third with a total of seven Complaints accounting for 8.64% of the total complaints.

Summary.

In order to enhance the outlook of the SACCOs through technology, the SASRA encourages the SACCOs to increase the adoption and usage of digitally enabled financial services and to upscale their investments in robust cyber security systems capable of warding-off cybercrimes and cyber-security risks and assuring reliability of online financial services to the members that would retain members’ confidence.

You can Download the whole report here