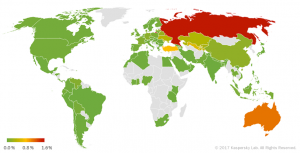

There has been a rise in the number of mobile banking threats where cyber attackers exploit vulnerable applications. The threats include mobile banking Trojans, third-party applications, web-based attacks, malicious programs for Automated Teller Machines (ATMs) and Point of Sale (POS) terminals. The geography of the mobile banking threats below shows the percentage of users attacked as provided by Kaspersky Lab:

How to Protect Yourself from the Mobile Threats

As mobile banking continues to grow, measures need to be taken to secure our devices against vulnerabilities that may occur from time to time. The main security checklists to be adhered to include:

- Implement two-factor authentication by adding more than one stage in the login process such as SMS text code to prove authenticity

- Ensure your device software is always updated and protected

- Read and understand permissions and privacy settings of applications before installing them. Be careful in granting third-part applications permission to personal information and performing functions on your phone.

- Avoid connecting to unsecured wifi network to prevent attackers from taking advantage and getting access to your device

- Protect session information to minimize entry of malware on to your mobile device, watch out for suspicious &fake applications

- Maintain a backup of data for retrieval in case of data loss.